Portfolio Construction & Client Proposals

Build client confidence through clean and convincing personalized portfolios.

Demonstrate portfolio alignment and illustrate benefits.

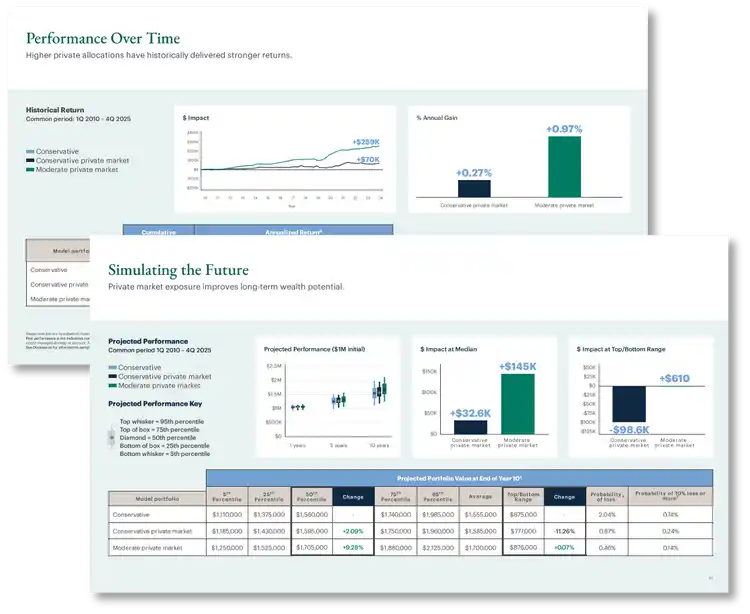

Generate compelling client ready visuals with clear analytics across public and private markets.

.webp?u=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fgbxcsezf%2Fproduction%2Fefd66f632e4ab05e65338dcb31c3634545cc7332-2524x1144.png&a=w%3D750%26h%3D340%26fm%3Dwebp%26q%3D40&cd=06535517482502da2f28965e99cf2e11)

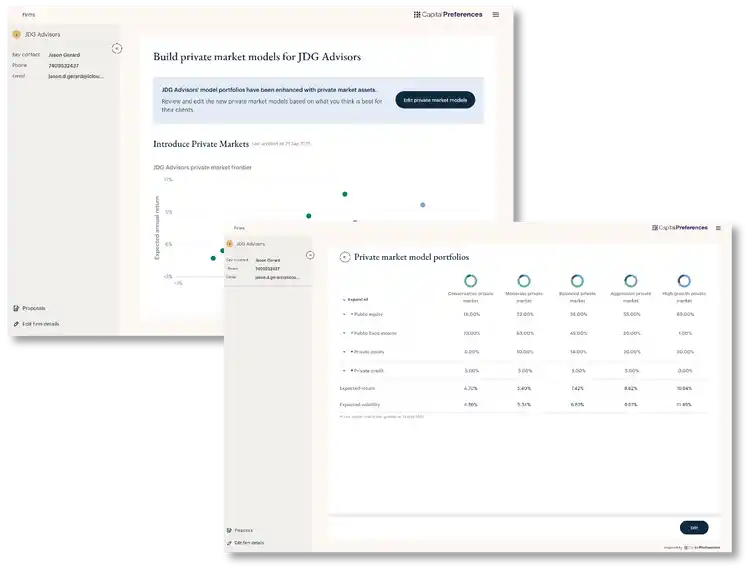

1. Smarter Portfolio Design

Rapidly model new portfolios across asset classes and markets, incorporating proprietary capital market assumptions.

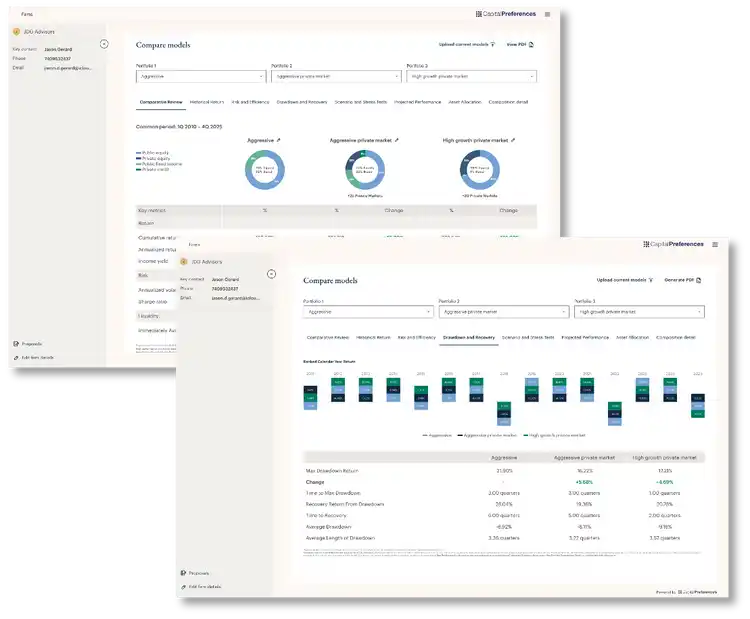

2. Informed Decision Making

Rapidly run side-by-side comparisons of portfolios with integrated analytics for risk, return, stress scenarios, and projected outcomes.

3. Compelling Presentations

Generate advisor-ready visuals with clear analytics, while maintaining control over how your strategies are presented.

Flexible Data Architecture

Our tech stack can pull in data from your preferred public markets, private markets, and ESG data providers.

The Client Alignment Challenge:

A $6.9 trillion Private Markets Advice Gap

.webp?u=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fgbxcsezf%2Fproduction%2F35d7cd64b18775e1aeab6d1bfe39d7296fab843b-1443x1015.png&a=w%3D750%26h%3D528%26fm%3Dwebp%26q%3D40&cd=88afcc337efee27c0a039bb54f2e54e7)