Client Discovery & Personalization

Maximize client relationship growth and differentiate your value proposition as a wealth manager.

Introducing the Economic Fingerprint®

We have implemented decades of internationally acclaimed and validated Decision Science and Behavioral Economics research to calculate an investor’s Economic Fingerprint®.

This rich dataset reveals how each investor makes life's core financial tradeoffs, unlocking continuous suitability and personalization.

.webp?u=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fgbxcsezf%2Fproduction%2Ffc22bc76ce0435bbd0e60afdd489fde6b4e16dd2-1514x1422.png&a=w%3D750%26h%3D704%26fm%3Dwebp%26q%3D40&cd=a24874cd4e92faeb8f4eb123d78c9e7f)

Systematically engage clients to create value at every stage of the relationship.

Deploy a modern discovery experience for acquisition, annual reviews, relationship expansion, household enfranchisement, and every other client touchpoint across the investing lifecycle.

.webp?u=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fgbxcsezf%2Fproduction%2F6ca2e5840d1095a88392b55dd111f1d85d0b9610-2194x782.png&a=w%3D750%26h%3D267%26fm%3Dwebp%26q%3D40&cd=5ab24000df52730d708ce0a8eae75981)

1. New Client Acquisition

Transform cold prospects into relationship ready leads using our scientific "give-get" methods.

.webp?u=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fgbxcsezf%2Fproduction%2F0ac7dc1511c562df56eeb26e8c98186b43d19551-900x1194.png&a=w%3D750%26h%3D995%26fm%3Dwebp%26q%3D40&cd=588a7650d019620d716a132e584c11a8)

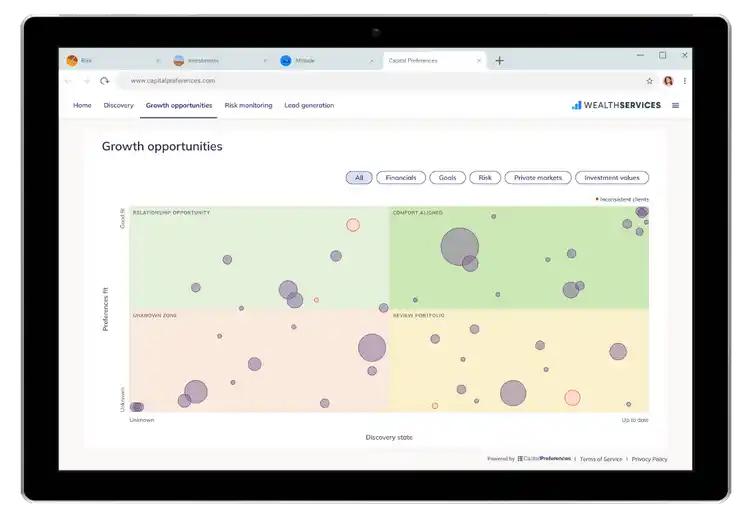

2. Client Relationship Growth

Activate clients' interest and monitor preference changes as the way to systematically meet more client’s needs.

3. Scalable Self-Directed Advice

Capture client preferences and deploy our Economic Fingerprint® Dataset to deliver superior self-directed advice, at scale.

.webp?u=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fgbxcsezf%2Fproduction%2Ffb423364ee14a30baeb8311c80f44dd50ce0bd0e-1824x1044.png&a=w%3D750%26h%3D429%26fm%3Dwebp%26q%3D40&cd=06138be4165014cebe3c5f8ffc25f081)

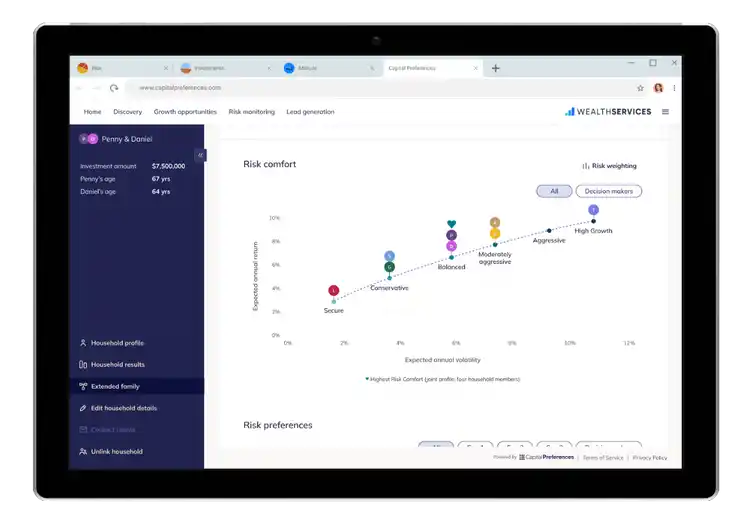

4. Multi-Gen and Household Expansion

Reveal how each family member thinks about money.

Engage and enfranchise the next generation in your advice practice.

5. Book of Business Insights

Every client is unique.

Anticipate how your clients will react to market swings and the changing investment landscape.