Foundations: stated vs. revealed preferences – part 2

Read time 5 minutes

In this post:

- Revealed preferences empower clients to show – not merely tell – their investment preferences

- The research and methodology behind revealed preferences

- The value of behavioral data in creating a personalized client experience

Part II: Revealed Preferences empower clients to show – not merely tell – their investment preferences

In order to move our industry forward, client profiling methods should employ the same rigor and meet the same standards that portfolio management does today. This is where the groundbreaking research and methodology of Revealed Preferences enters the industry and empowers advisors to understand their clients through the structured analysis of clients’ decisions, not their words.

The core philosophy of Revealed Preferences is simple:

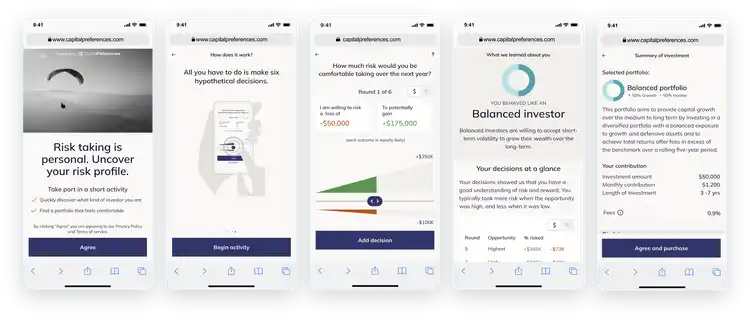

- Show, don’t tell – Use gamification to let clients naturally reveal their preferences regarding risk vs. return, today vs. tomorrow, and certain vs. ambiguous, rather than relying on stated preferences alone.

- Adopt technologies from the frontier of economic research – Use the most scientifically advanced decision games that can be administered efficiently to clients in order to scale an advisory practice, make digital financial services successful, and address looming compliance and regulatory concerns.

- Lever economic science and mathematics – Use quantitative and verifiable assessments of a client’s goals, constraints and preferences that have clear economic interpretations and direct implications for portfolio construction and financial planning.

In contrast to having clients answer a questionnaire and state their preferences, clients can complete a series of engaging and intuitive decision activities, through which they can demonstrate and reveal to their advisor how they make investment tradeoffs at varying levels of risk and reward.

The research and methodology behind Revealed Preferences

The research and methodology behind Revealed Preferences are backed by 20-years of research from Shachar Kariv, PhD, Former Chair of the Economics Department of University of California Berkeley, and Dan Silverman, PhD, Rondthaler Professor of Economics at Arizona State University. Their collective work focuses on reaching deeper levels of client understanding, in record time, through the structured analysis of clients’ decisions, not their words. Applying these methods to client profiling allows for a level of rigor, statistical confidence, and robustness that equips consumer financial services businesses with a new set of tools in their quest to add value.

The value of behavioral data in creating a personalized client experience

Founded on decision science and leveraging advanced computing power, gamification, and econometrics, these new and sophisticated methods are simple for the client. The output is rich data that enhances portfolio management and financial planning’s value by giving this process verified answers to crucially important questions, such as:

- How loss averse is this client?

- How risk tolerant?

- Does this client react negatively (become more risk averse) when facing uncertainty?

- What are this client’s time preferences?

- How does this client make tradeoffs relative to their many goals?

Going Forward: The value is in the client data. The successful advisor and firm of the future will create value by fully understanding their clients. Rich data will help them balance their goals, preferences, and constraints with products and services that reflect who they truly are. The advisors and firms who apply science and rigor to both portfolio optimization and client profiling will achieve personalization and growth at a scale previously impossible with traditional client-profiling methods.

To learn more about Revealed Preferences, visit our About the Science page.